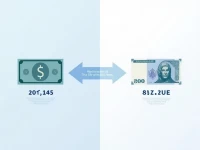

US Firms Optimize Costs by Converting Dollars to Swiss Francs

This article explains how to effectively convert US dollars to francs, providing the latest exchange rates and service options. It aims to assist users in achieving more efficient fund transfer and management in international transactions.